10

2022

Credit Memo & Credit Notes | Downloadable Templates In All Formats

A credit memo is one of the types of invoices that are mostly used by B2C businesses. Here we discuss all related topics of issuing credit notes with templates to download.

What is a Credit Memo?

The credit memo is one of the types of invoices that the seller or the bank issues to the buyer. A credit memo definition is a document issued to inform the buyer that the total amount he owes has been reduced to a certain amount.

When this memo is issued. The seller records a reduction in the receivable balance, but the buyer records a reduction in the payable balance. But if the payment had been done. The buyer would use the memo to reduce the payment of future transactions, or just ask for a refund.

The credit memo is the abbreviation of the term credit memorandum. It is sometimes referred to as credit memorandum or/and credit note interchangeably. After reduction, the buyer has to pay the amount specified exactly.

The sellers issue these invoices usually when the buyer disputes the prices of the product or the service provided. Or when the buyer returns goods to the seller or for many other reasons.

Learn More About OnlineInvoices

Make your business accounting easier.

Who issues A Credit Memo In Accounting?

There are two entities that may issue a credit memo:

- The Seller: He issues the memo to reduce the total payment of the goods.

- The Bank: After the seller issues the memo, the bank would issue this memo to decrease the deposited amount and increase the depositor’s account.

Reasons Why Credit Memos Are Issued:

Seller uses and issues a credit memo to return or reduce a certain amount of money out of the total payment. This is done for many reasons:

Price Dispute:

If the seller issues the memo to the buyer, then the buyer disputed the price for certain reasons. May be of the extra fees added or a marketing fee required.

Goods Return:

The seller issues a memo when the buyer returns one of the goods’ items. He though wants to reduce its price from the total payment. This happens for many reasons such as wrong sizes and colors.

Goods Damage:

If the billed goods are lost or damaged before they arrive, or damaged before their expiry date. The buyer would ask the seller for a credit to get his money back.

Price Change:

When a change in item price occurs, the seller would issue a memo to reduce the payment. If he wants to apply certain discounts on the products.

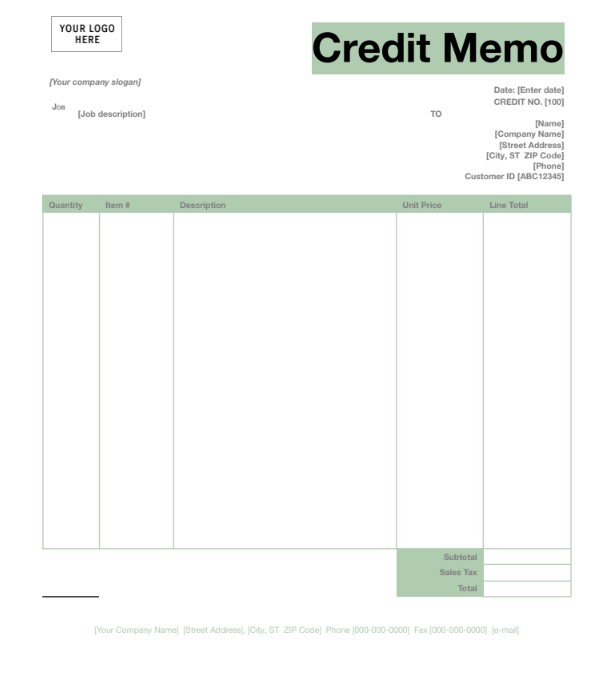

How To Issue A Credit Memo? What Should Be Included?

You can easier use invoicing software to handle all your invoices automatically. or just use invoice generator templates.

Writing a credit note is not so much different from writing a standard invoice. All the basic fields in the standard invoice are also required. In both invoices, you should include:

- Basic information about the seller and his company.

- The basic information about the buyer, contact, and shipping address.

- Issuing date and due date.

- Description of the goods.

- The total and unit price.

How To Apply A Credit Memo To An Invoice?

Although invoice and memo fields are similar, there are minor exceptions:

- The credit should refer to the original invoice that it depends on.

- Replacing the “invoice” header with the “Credit Memo or Credit Note” header.

- The credit will not carry a unique invoice number. It would rather carry the original invoice number.

The sellers issue these invoices usually when the buyer disputes the prices of the product or the service provided. Or when the buyer returns goods to the seller or for many other reasons.

Learn More About OnlineInvoices

Make your business accounting easier.

Credit Memo Example

An example of a credit note would be similar to the following: the seller issues an invoice of $1000 for 10 items. There is a problem with one item and the buyer has to return it. The seller receives it and issues a credit reducing the $100 of the damaged item.

Further, the bank would decrease the seller’s account for the buyers’ deducting the credit amount.

What Is The Difference Between The Credit Note And The Debit Note

Although there are many different types of invoices that have unique features that distinguish them from one another. But the debit memo and the credit memo are similar in many aspects but have different purposes. Although a credit reduces the payable amount of the invoices for the buyer. The debit memo asks either the seller or the buyer about a debt obligation.

The bank could also issue a debit memo to inform a buyer or a seller of extra fees on the original invoice that the buyer has to pay.

Credit Memo Templates To Download

Here are some basic credit memo templates to download. They are available in Microsoft Word, PDF, and Google Docs.

Pick the preferred credit memo template:

- Credit memo template in Microsoft Word.

- Google Docs for Credit memo template.

- Credit memo template in PDF.

Note: You need to make a copy of the credit memo/credit note in the Google Docs in your google drive account to start using the template. For the other formats, you just need to download and enjoy editing.

Archives

- October 2022

- June 2022

- May 2022

- April 2022

- February 2017

- November 2016

- October 2016

- July 2016

- June 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2014

- October 2013

- August 2013

- June 2013

- May 2013

- January 2013

- December 2012