12

2022

What is Proforma Invoice? | 5 Free Templates to Download

Many small business owners may misunderstand the meaning of a Proforma invoice. They may confuse the term with the other types of invoices although there are unique uses for each invoice type.

A pro forma invoice is, however, a primary draft invoice discussing details about the description of the goods or services, the delivery date, the expected fees, and transaction terms.

We are going here to discuss all the details about the pro forma invoice, the usage, and the difference between it and the other types of invoices. We include pro forma invoice templates and examples.

What is a proforma invoice?

Pro forma is a Latin term that stands for “for the sake of the form” or “as the matter of the form”. It means in Latin a primary agreement or document to be followed in the future when both parties agree on its terms.

A proforma invoice is a type of invoice that a seller sends before any transactions between the seller and the customer. It is an initial agreement between both parties about their transaction journey.

A pro forma invoice simply estimates and calculates the expected total payment of goods in consideration. It also includes the description of the goods in much more detail before the transaction occurs.

Although the Pro forma invoices are usually used for international trade when one party is exporting or importing. It is also written by all industries for internal trade to avoid any after-sale disagreement.

They specify the terms that would be discussed with the other parties and may be subjected to change furthermore before transactions take place.

So the simple proforma invoice definition is that it is an advance invoice sending a draft of a future invoice. It would add details regarding:

- The specified terms and conditions for the transaction of the specified goods such as the shipping dates.

- The description of goods or services: the quantities, the quality, the types, and the general physical specifications.

- The estimated payment such as the sale price, the shipping cost, the commissions, the taxes, and all the retail payments.

There is no invoice number for the pro forma. The main purpose of a pro forma invoice is to ensure that both parties are aware of everything in the deal. This will ensure that there would be no exposure to unanticipated charges.

When you issue a proforma invoice for your customers, you need to issue another commercial invoice within the following 120 days.

What is a pro forma invoice used for?

A Proforma invoice is used for advance payment. Sellers use it in international and internal transactions and trade before shipping. But the common share between them is the many related details.

Sellers issue it to receive approval of terms, goods, and amounts mentioned in the invoice.

When would it be better to send a proforma invoice?

There are many cases when you could send a proforma invoice, but some of these cases are not necessary. There are only two main cases when it is required to send a pro forma invoice:

- Estimating the total cost:

If you are dealing with goods that have variant expenses, you should pay attention to sending a pro forma invoice. This will allow the customer to be fully aware of all the expenses and fees he/she will afford. It makes you avoid any after-sale disagreements.

- International Trade

International shipping could be the main industry that uses pro forma invoices. This is because its process entails many aspects such as shipping cost, packaging, delivery time, goods weight, commissions, and more.

What is the Importance of a Pro forma Invoice?

After reading the above discussion, you would guess the general importance of using a proforma invoice for your business. The main benefits are the following:

- The customer is fully aware of the seller’s goods to match the expectation.

- It avoids any future disagreements after the sale.

- It identifies the terms and conditions for both parties in advance.

- Ensuring the intent of buyers and sellers to initiate and eventually close the deal.

- It reduces the transaction process to save time and cost.

Is a Proforma Invoice Legally Binding?

No. Customers are not legally bound to pay the payment mentioned in the pro forma invoice. However, they are legally bound to pay what is mentioned in the final invoice which is based on the pro forma.

The pro forma invoices do not have an invoice number which is the basic requirement for a legally binding invoice. These invoices would reclaim any value-added tax (VAT) in the company’s financial records and reports.

Note: We don’t expect it to be binding as the firms must issue commercial invoices within 120 days after the customer agrees.

Can a pro forma invoice be canceled?

The customers do not have to cancel the proforma invoice; it requires no action. It is just an offer and invoice draft with no binding.

If customers become interested, they will close the deal. If they are not, they will either negotiate or give no response.

What is the difference between a proforma invoice and the other types of invoices?

Although there are about 30 types of invoices, they all have a unique manner that differentiates them from the other types. Here are the types of invoices that are relatively close to the pro forma invoice:

Proforma Invoice Vs Normal Invoice

A pro forma invoice’s content is similar to the content of a normal invoice. But the normal invoice differs in:

- Carrying a unique sequence invoice number;

- It is legally binding to both parties;

- Both parties can’t change the signed terms or even edit them.

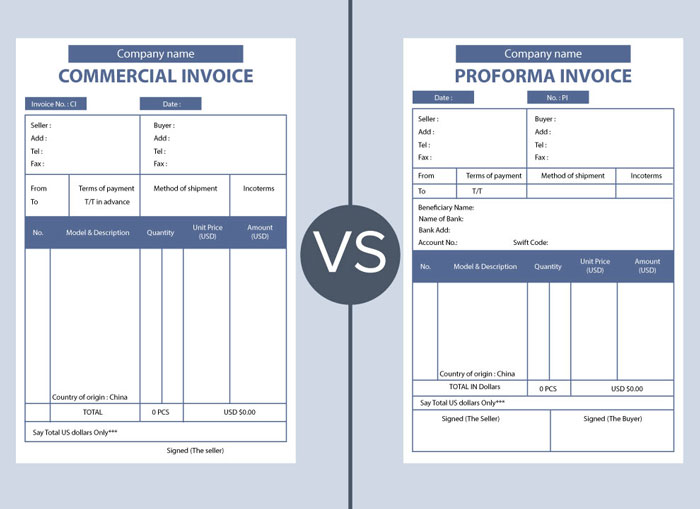

International Pro forma Invoice Vs Commercial Invoice

The commercial invoice is very similar to the pro forma invoice. But they could include more details about products and services provided. The commercial invoice is the next step of the proforma invoice after approving the deals within 120 days.

The unique characteristics of the commercial invoice:

- Contains a unique sequence invoice number.

- The issue and delivery dates.

- More details about the goods than the pro forma.

- Methods of payments.

Pro forma Invoice Vs Sales Invoice

A sales invoice is an after-sales invoice. It informs the customer that the goods have been delivered and the payment proforma invoice is due. The sales invoice is legally binding, unlike the pro forma invoice.

Proforma Invoice Vs Quotation Proforma Invoice

The Quotation Proforma Invoice and pro forma invoice are almost identical and interchangeably used to refer to the same concept. For example, both are draft invoices with no invoice number. But there are slight differences between both terms.

The professional uses of quotations occur during the early stages of the deal when the customers have just shown interest. Sellers send quotations to only inform the customer of the general outlines of the deal.

The proforma invoice is issued afterward to give more details about the proforma payment terms, total payment, and the description of the agreed-on goods.

Although you send a Quotation Pro forma Invoice to a potential client as a draft invoice, the proforma is a much more formal and professional way to do this.

Proforma Invoice Vs Tax Invoice

Although tax invoices and pro forma invoices contain almost all the basic information. Description of the service or goods provided, conditions, and payments.

The tax invoice is a document that specifies the tax of the foreign sales on commercial goods. It also must include the registered tax identification number of the company.

Proforma Invoice Vs Purchase Order

A purchase order is identical to the proforma invoice. The genuine difference between them is that the purchase order is sent by the buyer to order the products of the seller. On the other hand, the pro forma invoice is only sent by the seller.

How to Make a proforma invoice?

There are many templates and proforma invoice software that would do the job for you. Proforma invoice works for customs clearance. You can also customize them to fit your case. It is the fastest way to do a proforma invoice professionally.

On the other hand, you can create your own pro forma invoice using Microsoft Word or Excel. But it will take time to handle it, you need to take care of all details that need to be included.

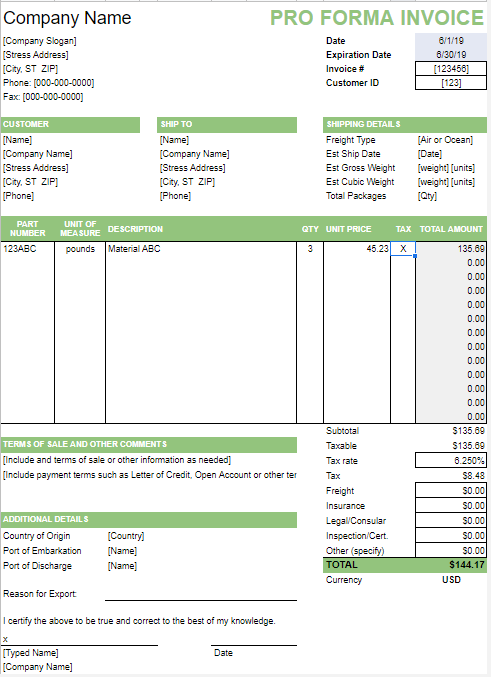

What Should Be Included In A Proforma Invoice?

There are many fields that could be added to pro forma invoice forms. But I will mention here only the basic fields that you could customize:

The Supplier’s Information:

- Company name and address;

- Company’s logo;

- Date of issuing and expiring;

- Authorized signature.

Your Client’s Information

- Clients name and address;

- Phone number and email address.

Payment Details

- Pro forma payment terms;

- Sale price;

- Shipping cost

- Commissions

- Discount (if it exists);

- Total amount due.

Products’ Information

- A detailed description of goods.

- Item names;

- Items quantity and quality;

- Unit and line total price;

- Tax rates.

Free Proforma Invoice Template and Examples | Quotation Proforma Invoice Templates:

Here are blank pro forma invoice templates that can be customized to suit your needs.

Don’t forget to make a copy or download the version you like and then start editing:

If you want to generate online invoices, use our pro forma invoice software to easily generate online Pro forma invoices.

Archives

- October 2022

- June 2022

- May 2022

- April 2022

- February 2017

- November 2016

- October 2016

- July 2016

- June 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2014

- October 2013

- August 2013

- June 2013

- May 2013

- January 2013

- December 2012